How to Trade Your Way to a $5MM / Month Company (Part 2)

After moving back to New York—one of the most expensive places in the world—I needed my business to generate serious revenue fast. But we were only selling low-ticket offers at the time.

In 2019, we relaunched our done-for-you sales funnel service, but I was essentially flying blind.

Then I created a simple spreadsheet. Nothing fancy—just a financial model that projected our path from that summer through December.

I mapped out optimistic, conservative, and realistic scenarios, tracking everything from traffic and lead generation to sales conversions. Suddenly, I could see exactly what inputs we needed each month to hit our targets.

That spreadsheet became our monthly business plan. We broke through $30K in monthly recurring revenue before year-end, exceeding even my optimistic projections.

The model didn't just give us direction—it made growth feel like a game we could actually win.

This article will show you how to break down your biggest goals into manageable steps and build momentum month after month. You'll learn how focusing on controllable inputs transforms abstract revenue goals into systematic, predictable growth.

What You'll Discover:

- Why a straightforward spreadsheet brings instant clarity (you can easily spot what’s moving the needle).

- How financial modeling becomes your safety net — making each month less stressful and every goal more achievable.

- The hidden method for staying nimble in a changing market (so you’re always ready to pivot, not just react).

Let’s get going…

Want to build a high-converting sales funnel—without the trial-and-error guesswork and expensive mistakes? Download our free checklist: 11-Point Perfect Sales Funnel Checklist and discover how to create custom funnels that convert, stand out from competitors, and scale your business without the overhead.

The Power of a Simple Spreadsheet

Let me tell you about one spreadsheet that changed my entire approach to business. It was a major reason why, when I relaunched the business in 2019, we hit our revenue targets consistently—even though the business model still had rough edges.

Back in the summer of 2019, after relaunching and starting to offer our done-for-you sales funnel service, I was under serious pressure. The company needed cash flow, and we had just wrapped up a year of selling info products, books, and courses.

That worked well and taught us a lot, and we made $48K in revenue that first year. But moving back to New York—where rent alone could bankrupt you—meant I needed the business to generate real money, fast.

So, we relaunched the service. And then, I did something simple that I should have done from day one: I built a financial model that tracked every number we needed to hit.

Why Financial Modeling Matters

In part, I believe we achieved what we did because I understood, at a granular and timeline-based level, what inputs were needed to produce the outputs our financial model projected.

At the time, I wasn’t even thinking about hitting $100K in monthly recurring revenue—we completely blew past that in 2021. I was just focused on the next $5K, the next $10K.

By the following year, when we broke $60K MRR for the first time, I was stunned. I’d had my head down, working hard, and suddenly realized, "Wow, that just happened." But ideally, you don’t want to just Forrest Gump your way to success.

Incremental Improvements and Strategic Focus

There’s a lot to be said for incremental improvements—keeping your head down, delivering great service, and executing on your marketing priorities. But you also need to ask: Where do you want to get the business to?

Having forethought and insight about the required inputs and how they match up with reality over time is crucial.

When we made our financial model, I did a cost of goods analysis to see our gross profit, added net expenses, and projected out from summer to December. I included optimistic, conservative, and realistic assumptions. Some months, we exceeded expectations; other months, we adjusted and pushed harder.

Overall, we exceeded expectations, breaking $30K MRR before year-end. The financial model closely tracked our achievements and gave me peace of mind.

It also made the process feel more like a game—racing against our previous month’s numbers.

Actionable Takeaway: Build a simple financial model—even if you think math isn’t your strong suit. It will give you a sense of control, direction, and excitement. As I always say, "It’s division, addition, and multiplication—elementary math."

Why This Approach Works

Most importantly, the financial model helps you see what inputs are needed in your marketing funnel to achieve your desired financial results. It’s like a business plan in numbers. Instead of focusing on distant, lofty goals, it grounds you in what needs to happen each month.

The following image highlights the key benefits of financial modeling:

- building cash flow projections, forecasting profits and losses

- planning budgets, improving financial performance and analysis, and

- making better investment appraisals.

Together, these benefits ensure businesses make data-driven decisions that align with real financial outcomes.

For example, you can predict the amount of traffic, expected opt-in rates, leads at the bottom of the funnel, and eventual sales. You can track these against reality and adjust as needed.

The model forces you to ask: "What actions must be happening to achieve these numbers?"

If your sales rate is lower than expected, the model prompts you to tweak your approach and test new hypotheses. It’s about continuous improvement and making meaningful changes to move the needle.

Inputs vs. Outputs: The Monthly Business Plan

Your financial projection becomes your business plan for the month. You compare one column of the spreadsheet—this month’s projections—against reality. That’s your focus.

Real-Life Example: The Importance of Relevant Traffic

One of the biggest factors in our early success was having relevant traffic aligned with what we were selling. We were considered an authority in the sales funnel niche, and our lead magnets attracted people already interested in growing their business.

The principle is simple: If you offer something people want and have a way to reach them, you will succeed. Without these two things, it’s not possible.

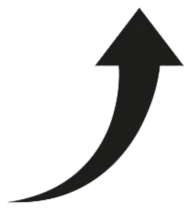

The chart that follows shows the top factors businesses attribute to traffic increases:

- Blogging - 25.07%

- SEO - 18.88%

- Other inbound marketing - 17.72%

- Social media - 16.86%

- Email marketing - 13.54%, and

- Paid search ads - 5.62%.

Blogging and SEO clearly stand out as the biggest drivers of growth.

If distribution is an issue for you, study others who have solved it. Back then, distribution wasn’t a problem for us, but now, with AI changing the landscape, it’s become more challenging.

Adapting to Market Changes

AI has upended traffic for many businesses, including ours. So, I’m doing what I recommend: learning from others who excel on social media and other channels. I’m absorbing strategies from experts like Dan Co, Alex Hormozi, Neil Patel, and others.

One key input is taking action to learn and upskill. You can learn by watching, reading, and studying what works for others.

The Enduring Principle: Quality Content Delivered Authentically

After years in business, I’ve found that quality content delivered authentically and consistently over time is the most reliable input for growth. The packaging may change, but the principle endures.

The image below emphasizes this by showing that nine out of ten consumers consider authenticity important when choosing which brands to support. Authenticity builds trust, which makes consistent, valuable content even more powerful in driving long-term growth.

This works because you’re giving people what they want. Even as algorithms change, if you focus on value, you’ll find ways to reach your audience.

Critical Assumptions for Success

All of this assumes you’re delivering on your marketing promise. If you’re not, your financial model will fall apart.

Whether you’re selling services, info products, or physical goods, you must provide real value and fulfill your promises.

The next image shows that one of the biggest drivers of brand trust comes down to keeping promises—protecting customer data, delivering quality, and being reliable. Trust is the result of doing what you say you’ll do.

If you get the basics right, your growth model can work. If not, you’ll face major hurdles.

Finding the Right Channels

Assuming you’re delivering value, the next step is to figure out the optimum channels for top-of-funnel traffic. Once you do, your funnel will light up.

You’ll see compounding results as you reinvest profits and achieve bigger outputs each month.

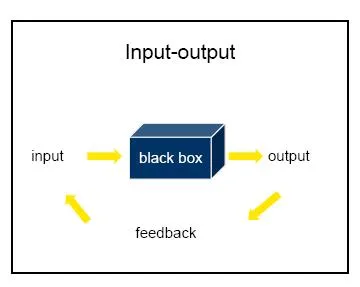

Focusing on Inputs You Can Control

Each month, focus on the specific actions that will help you hit your numbers: publishing content, sending cold emails, running ads, nurturing leads, and creating new offers. The beauty is that these inputs are controllable.

You can’t control individual buying decisions, but you can maximize the probability that your system will convert. If you’re not getting results, examine your inputs and make adjustments.

The diagram below illustrates the input-output model, where controllable inputs flow into a “black box” system that produces outputs, with feedback loops guiding future adjustments. It highlights how focusing on inputs and refining them based on feedback drives better results over time.

As I like to say, "Focus on the field, and the scoreboard will take care of itself."

Why This Matters for You

This systematic approach is the exact framework I used to scale Growbo to $1.2 million in monthly revenue in 2021 and beyond. It’s what I wish I’d used earlier, and what I would advise my younger self to do to save time and avoid mistakes.

But here’s the reality: executing consistently, creating content, managing campaigns, hiring and training a team—this can be overwhelming and expensive. That’s why I built Growbo’s current offering: reliable marketing execution without the day-to-day headaches.

With Growbo, you get a complete marketing team that handles execution while you focus on strategy and growth. There are no long-term contracts, and you can get started for a fraction of the cost of hiring your own team.

We work with agencies, SaaS businesses, coaches, consultants, and e-commerce brands. You can even white-label our services if you’re an agency.

Actionable Takeaways

- Create a simple financial model to track your business growth month by month.

- Focus on controllable inputs—publishing, outreach, and nurturing leads.

- Deliver real value and fulfill your marketing promises.

- Learn from others who have solved distribution and marketing challenges.

- Adapt to changes in the market by upskilling and testing new channels.

Final Thoughts

Systematic execution and financial modeling aren’t just for big companies—they’re for anyone who wants to build a sustainable, growing business. Use these tools to guide your actions, stay grounded, and achieve your goals.

If you want help executing your marketing plan, check out Growbo for a reliable, done-for-you solution.

Remember, focus on your inputs, measure against your outputs, and keep improving. That’s the path to real, lasting success.

Keep Growing, Stay Focused,

Image Credits:

1. https://alcorfund.com/insight/financial-modeling-to-maximize-your-startups-growth-potential/

2. https://53.fs1.hubspotusercontent-na1.net/hub/53/hubfs/inbound-marketing-lead-gen-data_5.webp?width=619&height=364&name=inbound-marketing-lead-gen-data_5.webp

3. https://openr.co/how-does-social-media-affect-authenticity/

4. https://www.qualtrics.com/experience-management/brand/brand-trust/

5. https://th.bing.com/th/id/R.b49d29a2bf8c766fda1a973d1d9178be?rik=W0NFSSuyVOl9jA&riu=http%3a%2f%2fwww.shmula.com%2fwp-content%2fuploads%2f2010%2f08%2finput-output-lean-six-sigma.jpg&ehk=clA14pADjtbDEmX5FGf8aPflJQ0BHBpE7GwGpM42fn8%3d&risl=&pid=ImgRaw&r=0